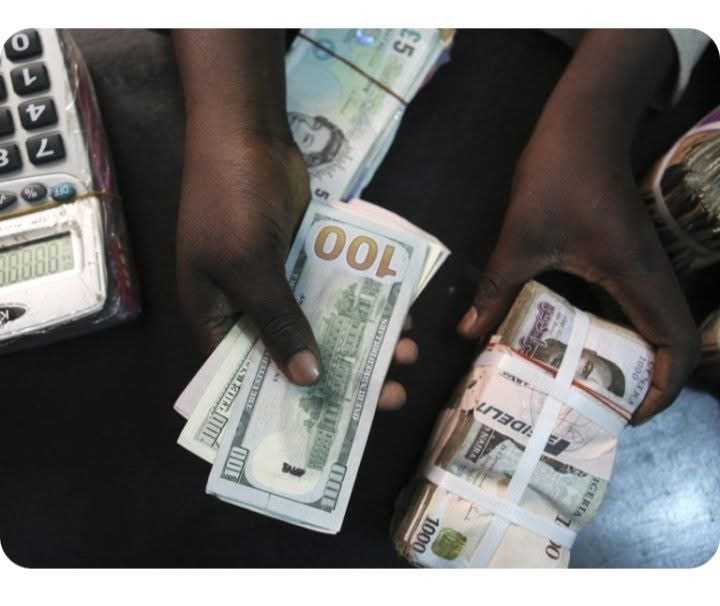

The dollar began the new week with gains against the naira in the foreign exchange market. Data from the Central Bank of Nigeria showed that on Tuesday, August 12, the naira ended trading at N1,537.09 per dollar in the official Nigerian Foreign Exchange Market (NFEM).

This represents a 0.076% drop or N1.77 loss for the naira in the official market when compared to Monday’s N1,535.9.

Naira performance against dollar, pound, euro

However, it was a slightly better outcome for the naira when paired with the pound sterling and the euro. In the spot market, the naira edged up by 20 kobo against the pound sterling to settle at N2,060.14/£1 from the previous rate of N2,060.34/£1. Against the euro, the naira appreciated by N3.85, closing at N1,782.75/€1 compared to the earlier N1,786.60/€1. These slight gains in the FX market point to better sentiment and higher supply, which helped ease pressure.

Snapshot of current exchange rates:

CFA franc: N2.72

Chinese yuan (renminbi): N213.76

Danish krone: N238.82

Euro: N1,782.75

Japanese yen: N10.38

Saudi riyal: N409.25

South African rand: N86.50

SDR: N2,106.83

Swiss franc: N1,889.68

Pound sterling: N2,060.14

WAUA: N2,093.23

Naira weakens against dollar in the black market

In the parallel or black market, the naira also lost ground against the US dollar.

Currency traders who spoke with Legit.ng confirmed the decline. Abdullahi, a Bureau De Change (BDC) operator, stated:

“On Tuesday, the dollar was bought at N1,547 and sold at N1,553. The euro traded between N1,770 and N1,785, while the pound sterling ranged between N2,070 and N2,085.

“Last Friday, the dollar was purchased at N1,540 and sold at N1,550, with the euro and pound remaining in the same bands of N1,770–N1,785 and N2,070–N2,085 respectively.”

Rewane’s projection on the naira

Earlier, Wizopa Learnt that Bismarck Rewane, CEO of Financial Derivatives Company, predicted the naira could close at N1,492/$ by 2025. He attributed this forecast to factors such as the localization of corporate debt, stronger diaspora inflows and remittances, and a possible Eurobond issuance.

These elements, he said, are likely to boost dollar availability and help ease exchange rate pressures.

SEE MORE RELATED TOPICS: